HRA Plan News – Federal Regulations Provide Two New HRAs

Many employers offer an HRA plan, but new varieties are on the way. On June 13th, 2019, The United States Treasury Department, Department of Labor, and Department of Health and Human Services issued a final ruling that lets employers offer an Excepted Benefit HRA (EBHRA) and an Individual Coverage HRA (ICHRA). Employers are celebrating the new federal regulations as both new HRAs offer a cost-effective way to provide high value benefits to their employees. Both new types of HRAs are tax advantaged accounts that will go into effect January 1st, 2020, but employers should take note of their specific differences.

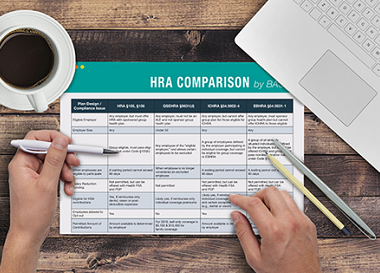

Click here to download our HRA Comparison Chart.

An ICHRA lets employers reimburse employees for Medicare premiums or insurance policies purchased in the individual market, as well as certain medical expenses. An EBHRA lets employers reimburse employees for out of pocket medical expenses such as dental, vision, and short-term or limited disability insurance. An employer cannot offer both an ICHRA and EBHRA to the same employees. An EBHRA is an efficient option for employers offering group coverage but not dental or vision, allowing employees to use the EBHRA to save money on services not covered by their group health plan. EBHRAs must be offered to all similarly situated employees.

Any employer can offer an ICHRA to an employer-defined class of employees, but they cannot offer a choice between traditional group health plans and an ICHRA. Employers who want to offer an EBHRA can only do so if they also offer major medical coverage. The new HRAs also differ in their annual contribution limits. The ICHRA contribution limit is set by the employer, whereas the EBHRA contribution limit is set at $1,800 per year (this amount is expected to increase after 2020 and annual roll-over amounts are not counted against the contribution limit).

BASIC has been a leading HRA administrator for years, offering flexible plan designs and dedicated account managers for every HRA client. Our industry leading compliance expertise means your BASIC ICHRA or EBHRA will fully conform with IRS regulations. We provide all the necessary documents such as Legal Plan Documents and Summary Plan Descriptions, as well as manage all reimbursements and claim substantiations. We even review employee classes to prevent discrimination and noncompliance! Choosing BASIC HRA administration means providing a rich benefit solution with unmatched service every step of the way.

Request a proposal today to see how BASIC can upgrade your benefits package!